Press Release Webinar Market Review and Mini Outlook Ramadhan

In order to provide in-depth insight into capital market movements at the beginning of the year and investment strategies during Ramadan, lecturers from the Management Study Program at UBM Ancol Campus, namely Dr. Siti Yasmina Zubaedah, BSIE., MSIE, Elkunny Dovir Siratan, S.Par., MM, Sophia Reni Susilo, SE., MM, Very Budiyanto, S.M., M.SE., Alexander Robert, BA., MSc, Dr. Velly Anatasia, SE., MBA, along with students from the Management Study Program at UBM Ancol Campus, Hellen Junita, Elza Jiuni Shen, and Kayleen Mieko Torhuta, participated in the “Market Review and Mini Outlook Ramadan 2025” webinar successfully organized by MNC Sekuritas on March 6, 13, and 19, 2025.

This event presented a comprehensive analysis of the movement of the Composite Stock Price Index (IHSG), factors influencing the market, and potential stock recommendations for investors.

Session 1 (Thursday, March 6, 2025): Understanding Capital Market Dynamics and Investment Strategies During Ramadan\

Since early 2025, IHSG has been on a declining trend, correcting by 7.3% Year-to-Date (YTD), accompanied by an outflow of foreign and domestic funds amounting to IDR 21.5 trillion. Several key factors influencing this movement include:

- U.S. import tariff policies under Donald Trump’s administration, which tightened trade with China, Canada, and Mexico.

- The Fed’s hawkish stance on interest rate cuts, with potential adjustments in June, July, and October 2025.

- China’s economic stimulus increasing the attractiveness of its capital market, diverting foreign investment from Indonesia to China.

- The downgrade of MSCI Indonesia by Morgan Stanley, reducing the appeal of Indonesian stocks to global investors.

- Uncertainty surrounding the Danantara program, leading investors to adopt a wait-and-see approach toward state-owned bank issuers.

Although Ramadan is often associated with increased consumption, annual inflation tends to remain stable as it is more influenced by structural factors such as energy and food prices. IHSG movements during Ramadan typically consolidate or experience corrections as investors tend to engage in profit-taking before the Eid holiday. Aside from the consumer & retail sectors, which often benefit, technology, energy, transportation, industrial, and property sectors also show growth potential during this period.

Session 2 (Thursday, March 13, 2025): Optimizing Technical Analysis for More Accurate Investment Decisions

To enhance investor literacy on Sharia stocks, a webinar titled “Sharia Stock Trading Strategies with Technical Analysis” was successfully held. This event provided various strategies and tips for analyzing Sharia stocks using a Technical Analysis (TA) approach to help investors make more optimal trading decisions.

Technical analysis is a method for studying price movements and transaction volume to predict future market trends. The core principle of technical analysis is that prices tend to move in specific patterns influenced by investor emotions and psychology. Therefore, understanding market trends is key to making investment decisions.

Technical analysis methods are categorized into two:

- Classical Technical Analysis, uses trendlines to determine support and resistance levels and reads momentum from price charts.

- Modern Technical Analysis, relies on mathematical indicators such as Moving Averages, RSI, Bollinger Bands, and others to identify trends, reversal points, and the strength of price movements.

Through this webinar, participants gained strategic insights into investing in Sharia stocks using technical analysis. With a better understanding of trends, support & resistance, and technical indicators, investors can make wiser trading decisions aligned with Sharia principles.

Session 3 (Thursday, March 19, 2025): Sharia Stock Trading Strategy Breakdown: Optimizing Super Order Features for Transaction Efficiency

To further enhance investor understanding of more effective and efficient Sharia stock trading strategies, a webinar titled “Sharia Stock Trading Strategy Breakdown with Super Order” was successfully conducted. This session discussed the utilization of the Super Order feature in Sharia stock trading, including the application of order algorithms to maximize profit opportunities and manage risks automatically.

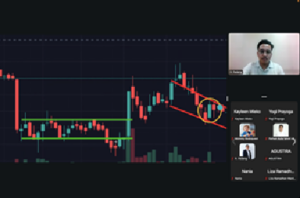

One of the main topics covered was the concept of Breakout and Breakdown in stock price movements:

- Breakout occurs when a stock price surpasses the resistance level, indicating potential further price increases.

- Breakdown happens when a stock price falls below the support level, signaling a potential further decline.

Additionally, participants were introduced to the difference between:

- Reversal vs. Breakout/Breakdown:

- Reversal refers to a trend direction change (from bullish to bearish or vice versa).

- Breakout/Breakdown is the continuation of a trend after breaking a support or resistance level, rather than a trend reversal.

Besides the main strategies, this webinar also discussed the Bottom Fishing technique—a strategy of buying stocks at their lowest level with the expectation of a rebound. This strategy is generally applied to stocks with strong fundamentals that are experiencing temporary pressure due to negative sentiment.

Through this webinar, investors gained new insights into Sharia stock trading strategies using technical analysis and how to optimize them for increased transaction efficiency. By utilizing the right order algorithms, investors can become more disciplined in executing trading strategies while reducing unexpected risks. It is hoped that this education will help Sharia investors make more accurate trading decisions, aligned with Sharia principles, supported by technology and real-time data. With more investors understanding these strategies and features, it is expected that Indonesia’s Sharia stock investment ecosystem will continue to grow rapidly.